Ontario Bad Credit Car Loans: How to Get Approved (O.A.C.) and Choose the Right Vehicle

- Rick Paletta

- Jan 19

- 6 min read

Learn how Ontario bad credit car loans work, what lenders look for, and how to shop smart in the GTHA—without judgement, and with budget-first steps you can take today.

If you’re looking for an Ontario bad credit car loan, you’re not alone—and you’re not “behind.” Life happens: a job change, a separation, higher rent, a few missed payments, or a fresh start after a proposal or bankruptcy.

Our team helps drivers across the Burlington–Hamilton corridor (and beyond into Oakville, Milton, and Mississauga) find realistic financing options and vehicles that fit real monthly budgets—especially when credit is bruised, thin, or rebuilding.

The goal isn’t just “a car.” It’s a payment, total cost, and vehicle choice you can live with—so you can keep moving forward. Financing is O.A.C. (On Approved Credit. Conditions may apply.)

Key Takeaways

Pre-approval matters: it helps you shop within a real budget and reduces surprises.

Lenders look beyond score: income stability, down payment, and the vehicle itself can matter a lot.

Used can be a smart move: the “right” used SUV/sedan can keep total cost lower.

Trade-ins and negative equity need a plan—rolling balances can raise payment and total cost.

You can start by browsing our inventory at Car Nation Canada vehicles and exploring next steps through our finance centre.

What “Bad Credit Auto Financing” Means in Ontario

“Bad credit” usually means your credit history shows higher risk to a lender (missed payments, collections, high utilization, short credit file, recent delinquencies, or major events like a consumer proposal).

In Ontario, a bad credit car loan is typically structured so the lender can feel comfortable with the risk—often through:

a more conservative vehicle choice (price, age, mileage),

a down payment or trade equity,

proof of income and stability,

a term length that fits affordability while managing total cost.

If you want a quick reality check on your credit file before you apply, you can pull your report directly through Canada’s credit bureaus like Equifax Canada or TransUnion Canada while you build a plan.

What Lenders Look For (It’s Not Just the Score)

When someone is shopping for an Ontario bad credit car loan, lenders commonly weigh a few big factors:

Income and stability

They want to see that payments are realistically manageable. If you’re hourly, seasonal, or newer at your job, that’s not necessarily a “no”—it just means documentation and structure matter more.

Debt load and payment comfort

A practical rule: focus on a payment that leaves breathing room for fuel, maintenance, and insurance. If you want budgeting help, the consumer tools on the Financial Consumer Agency of Canada site can be useful while you plan.

Down payment or trade equity

A down payment can reduce the amount financed and may help with approval odds (O.A.C.). Trade equity can play the same role.

The vehicle itself (loan-to-value)

For bad credit auto financing, the lender may prefer vehicles that fit their guidelines on age, mileage, and book value—because that reduces risk.

Step-by-Step: How to Get an Ontario Bad Credit Car Loan (O.A.C.)

Here’s the process we recommend for Ontario shoppers—especially commuters and families in the GTHA who need a vehicle soon.

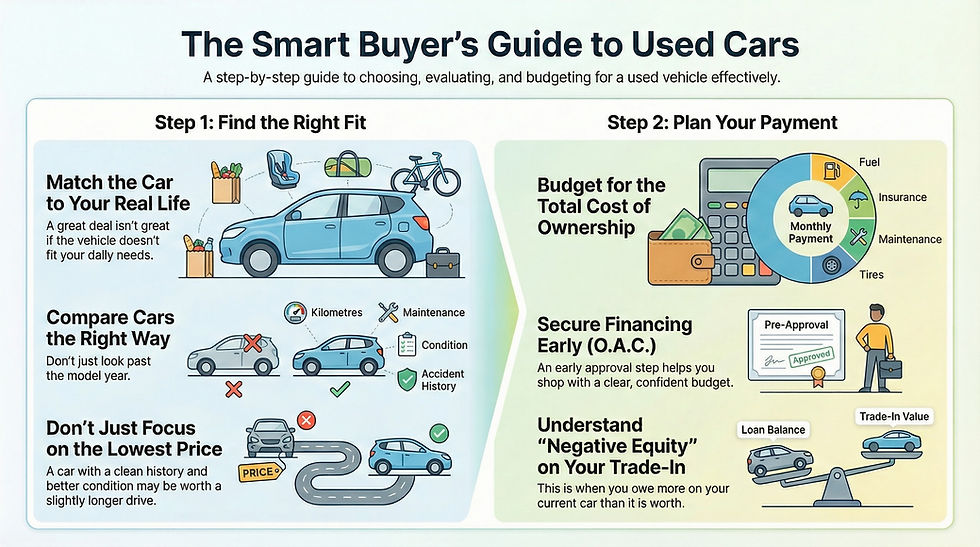

1) Set a “real” monthly budget (not just a price)

Start with a payment range you can sustain. Remember to include:

insurance (often higher on newer or higher-value vehicles),

fuel (L/100 km varies a lot by body style),

maintenance and tires,

licensing and taxes.

If your main goal is payment relief, sometimes a slightly older, reliable sedan is smarter than stretching into a large SUV.

2) Get pre-approved before you fall in love with a vehicle

A pre-approval helps you avoid wasting time and narrows your search to vehicles you can realistically finance. You can begin the process through our finance page with O.A.C. terms.

3) Choose the right body style for your life (and your budget)

Bad credit approvals are often smoother when the vehicle fits lender guidelines and your needs.

Common picks in Southern Ontario:

Sedans / compacts for commuter value (often lower fuel use and purchase price)

SUVs for winter confidence and family practicality

Minivans for families who need real space (and want sliding-door sanity)

Trucks when work requires it—just be careful: higher purchase prices can raise payment

You can start filtering by body style and budget right inside our vehicle inventory while keeping the payment goal front and centre.

4) Plan your documents in advance

Common items lenders may request:

driver’s licence (Ontario),

proof of income (pay stubs or bank statements),

proof of address,

details on your trade-in (if applicable).

For newcomers to Canada (thin file), extra documentation can help show stability—work permit status, proof of employment, or longer bank history.

5) Pick a term length wisely (don’t chase the lowest payment only)

Longer terms can lower payments, but they can also increase total interest paid over time. If you’re weighing 60 vs. 84 vs. 96 months, it’s worth comparing the total cost—not just the monthly number.

Canadian auto loan terms can run up to 96 months in many cases, and rates vary widely by credit profile.

Trade-Ins and Negative Equity: The Part Most People Don’t Explain

If you owe more on your current vehicle than it’s worth, that’s negative equity (sometimes called “upside down”). It’s common—especially if you had a longer term, higher rate, or bought during a high-price market.

What happens next?

You may be able to roll the negative equity into the next loan (O.A.C.), but it can raise your payment and total cost.

A down payment can sometimes offset part of the rollover.

Choosing a vehicle with a more suitable price point can reduce lender risk and improve structure options.

If you’re unsure where you stand, start by getting a realistic appraisal and then browse our inventory with a clear “all-in” budget in mind.

Ontario Trust & Transparency: What to Expect From Financing Conversations

In Ontario, shoppers deserve clarity—especially around financing ads and disclosures. OMVIC’s advertising guideline highlights that if an ad includes an interest rate or payment amount, it must also disclose key financing details like APR and term, and that “see dealer for details” isn’t a replacement for required disclosure.

That’s why we focus on straightforward conversations:

what you’re approved for (O.A.C.),

what the term length means for total cost,

what vehicle options best match your approval structure,

and what you can do next month to improve your situation further.

Best Vehicle Types for Budget-Focused Buyers Rebuilding Credit

If your priority is “get approved and keep the payment manageable,” these are often strong directions:

Reliable commuter sedans and small SUVs

They’re usually easier on fuel and can be easier to finance at lower amounts.

Value-focused used SUVs for families

A used SUV can be a solid middle ground when you need space but want to avoid a too-high payment.

“Fresh start” picks for post-proposal or bankruptcy

When rebuilding, the win is a vehicle you can maintain plus a payment you can make every month. If your situation is a fresh start, begin with a short list from our inventory and pair it with a plan through our finance centre so you’re not guessing.

Local Ontario Notes: Matching the Vehicle to Your Reality

Drivers commuting through the QEW corridor from Grimsby into Burlington or heading toward Mississauga often prioritize fuel economy and reliability, while families in Hamilton and Brantford may prioritize space, safety, and predictable maintenance costs.

The “best” vehicle is the one that fits:

your commute,

your parking situation,

your winter comfort needs,

and your monthly budget—without stretching you thin.

Conclusion: Get an Ontario Bad Credit Car Loan Without the Stress

If you need an Ontario bad credit car loan, the best approach is simple: start with the payment, get pre-approved (O.A.C.), then choose a vehicle that fits both your life and lender guidelines. With the right structure, many credit situations have workable paths forward.

Your next step:

Browse Car Nation Canada inventory for cars, SUVs, trucks, and minivans that match your budget, then start a no-pressure pre-approval through our finance centre (O.A.C. / Conditions may apply).

FAQ: Ontario Bad Credit Auto Financing

1) Can I get approved for a car loan in Ontario with bad credit?

Often, yes—financing options are available for many credit situations, but approval and terms depend on your full application, income, and the vehicle (O.A.C. / Conditions may apply).

2) Do I need a down payment for a bad credit car loan?

Not always, but a down payment can help reduce the amount financed and may improve overall terms (O.A.C.). It can also help if you have negative equity.

3) Will a bad credit car loan help rebuild my credit?

If your lender reports to credit bureaus, consistent on-time payments may help over time. You can monitor progress through your bureau file at Equifax Canada or TransUnion Canada.

4) Is it better to finance new or used with bad credit?

It depends on budget and approval structure (O.A.C.). Used vehicles can keep the amount financed lower, but the “best” choice is the one that keeps your payment sustainable.

5) What documents should I prepare?

Typically: driver’s license, proof of income, proof of address, and trade-in details if applicable. Newcomers may benefit from extra proof of stability.

With over four decades in the automotive industry, Dealer Principal Rick Paletta is a trusted name across the Hamilton–Burlington region. Born and raised locally, Rick is respected for his integrity, work ethic, and people-first leadership—and he still loves this business because it’s about helping neighbours, building relationships, and matching people with vehicles they’re excited to drive. His commitment to the community shows up in consistent giving, including long-running support of McMaster Children’s Hospital through Car Nation Cares.

Comments