Blue Book Value Canada: How to Find Your Car’s Real Value in Ontario

- Rick Paletta

- Jan 22

- 5 min read

If you’re searching “blue book value Canada,” you’re really trying to find a fair, today price for your vehicle—here’s a practical Ontario-first way to do it (and how to turn that value into a smarter next purchase).

If you’ve ever typed “blue book value Canada” before selling, trading in, or buying a used vehicle, you’re not alone. In Canada, “blue book” has become shorthand for: What would my car realistically sell for right now?

But here’s the catch: the right value depends on your plan—selling privately in your driveway, trading in at a dealership, or buying your next vehicle and trying to keep payments comfortable.

Our team at Car Nation Canada works with payment-focused shoppers every day—commuters, growing families, newcomers, and fresh-start buyers—so this guide is designed to help you find a realistic number and use it to make the next step easier.

Key Takeaways

“Blue book value” in Canada usually means current market value, not one universal number.

You should estimate three prices: trade-in, private sale, and retail.

Your vehicle’s km, condition, trim, and local demand (e.g., Burlington vs. Mississauga) can change pricing more than people expect.

If you’re trading in, your value can affect your budget, loan payoff, and negative equity—not just the sticker price.

When you’re ready, you can browse vehicles that fit your budget on our inventory page and explore options with a finance pre-approval (O.A.C.).

What “Blue Book Value” Means in Canada Today

In practical terms, Canadians use “blue book value” to mean a trustworthy price estimate based on:

make/model/year

trim level and options

kilometres (km)

condition and history

what similar vehicles are actually selling for locally

Instead of hunting for one magic number, aim to build a value range you can defend with evidence.

Step 1: Gather the Details That Move the Price

Before you price anything, write down:

Year / make / model

Trim (this matters a lot—base vs premium can be thousands)

Odometer in km

Drivetrain (FWD/AWD/4x4), engine, fuel type

Accident history and repairs

Tire/brake condition, windshield chips, warning lights

Maintenance records (even photos of receipts help)

Quick rule: if you’re not sure whether something matters, assume it does—because buyers and appraisers will notice it.

Step 2: Estimate Three Different Values (Trade-In vs Private vs Retail)

Trade-in value

This is the amount you might receive when you apply your current vehicle toward your next one. Trade-in numbers often reflect reconditioning costs and resale risk.

Best for: convenience + time savings.

Private-sale value

This is what you might get selling on your own (usually higher than trade-in), but it can take longer and requires paperwork, meetups, and screening.

Best for: maximizing dollars if you have time and energy.

Retail value

This is what dealers typically list a similar vehicle for. It includes overhead, reconditioning, and consumer protections—so it’s usually the highest number.

Best for: understanding what you’ll pay when you’re buying.

Step 3: “Local Market” Matters More Than You Think

Southern Ontario prices can vary by:

seasonality (winter tire season, spring SUV demand)

fuel prices and shifts toward efficient vehicles

supply in your area (GTHA vs Niagara corridor)

buyer preferences (AWD demand in winter months)

If you live near Burlington, compare listings across nearby pockets like Hamilton, Oakville, Milton, and Grimsby to avoid overpricing—or underselling.

Step 4: Use Ontario-Specific Paperwork to Protect Your Price

If you’re selling privately in Ontario, the province is very clear about what sellers must provide. For example, the seller is legally required to provide a Used Vehicle Information Package (UVIP) when selling a used vehicle privately.

That matters for “blue book value” because:

Buyers trust you more when you’re prepared

Clean paperwork reduces renegotiation

You’ll move faster and protect your asking price

Helpful Ontario references to keep close while you price and sell:

Ontario’s UVIP overview and requirements

Ontario’s steps to buy or sell a used vehicle (bill of sale, transfer basics)

Step 5: Don’t Forget Buyer Protections When You’re Comparing Dealer Prices

When you’re comparing retail listings to estimate value, remember Ontario has consumer protection expectations around advertised pricing from dealers—commonly described as “all-in price advertising,” where ads must include the costs a dealer intends to collect (with limited exceptions like HST/licensing).

That’s important because it helps you compare retail pricing more apples-to-apples when you’re trying to decide whether your private-sale price is realistic.

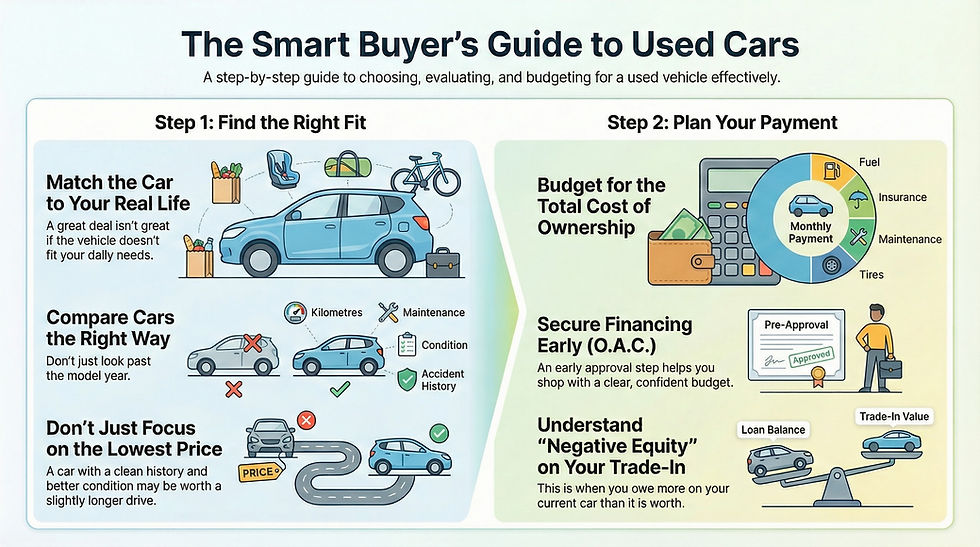

Step 6: Turning Your Value Into a Smarter Next Purchase (Payments, Not Just Price)

This is the part many “blue book value” guides skip.

If you’re trade-in shopping and payment-focused, your vehicle’s value affects:

1) Your down payment effect

Trade value can reduce what you need to finance on your next vehicle—helpful if you’re budgeting carefully.

2) Negative equity (if you owe more than it’s worth)

If your loan payoff is higher than your trade value, the difference is negative equity. You may still have options, but it’s crucial to plan around total cost—not just monthly payments.

3) Term length and total cost

A longer term can lower a payment but increase total borrowing cost. Balance payment comfort with the big picture.

If you want to map this out with fewer surprises, start with a no-pressure online step: our finance application / pre-approval (O.A.C., conditions may apply). Then browse vehicles that fit your budget on our inventory page.

Step 7: A Simple “Blue Book Value Canada” Checklist You Can Use Today

Pick your goal: trade-in, private sale, or buying

Build your vehicle profile (trim + km + condition)

Compare local listings across your region (e.g., Burlington + Brantford + Mississauga)

Set a value range (not one number)

Decide your next step:

Sell privately (prep UVIP + paperwork)

Trade in and shop your next ride (focus on budget + total cost)

Buy now and compare fair retail pricing expectations

Conclusion

“Blue book value Canada” isn’t about chasing a single perfect number—it’s about finding a realistic market range based on your vehicle, your local area, and your plan (sell, trade, or buy).

If you’re ready to turn your current vehicle into your next one—without guesswork—start here:

Browse what’s available right now: Car Nation Canada inventory

Explore financing options for many credit situations: Get pre-approved (O.A.C., conditions may apply)

FAQ

What’s the most accurate “blue book value” in Canada?

The most accurate approach is building a local market range using comparable vehicles (same trim, similar km, similar condition) and separating trade-in vs private-sale vs retail.

Why is my trade-in value lower than my private-sale value?

Trade-in offers often account for reconditioning, warranty/retail prep, and resale risk. Private sale can net more, but it usually takes more time and effort.

What do I need to sell a used vehicle privately in Ontario?

Ontario requires the seller to provide a Used Vehicle Information Package (UVIP) to the buyer, and there are specific steps for bills of sale and transfers.

What is “all-in pricing” and why does it matter when valuing a car?

All-in pricing expectations help you compare dealer ads more fairly when you’re estimating retail value.

If I’m upside down (negative equity), can I still trade in?

Often, yes—financing structures may be available depending on your situation and the vehicle (O.A.C.). The key is to review total cost and choose a vehicle/payment plan that makes sense for your budget.

--------------------------------------------------------------------------------------------------------------------------

With over four decades in the automotive industry, Dealer Principal Rick Paletta is a trusted name across the Hamilton–Burlington region. Born and raised locally, Rick is respected for his integrity, work ethic, and people-first leadership—and he still loves this business because it’s about helping neighbours, building relationships, and matching people with vehicles they’re excited to drive. His commitment to the community shows up in consistent giving, including long-running support of McMaster Children’s Hospital through Car Nation Cares.

Comments